For decades, utilities have relied on SCADA (supervisory control and data acquisition) systems to enable remote monitoring of generation and transmission systems. “Transmission systems have always been very critical,” says Prad Tripathy, Director, Solutions Product Management at Landis+Gyr. “So, utilities have been very proactive in monitoring that area. When it comes to distribution, that hasn’t always been the case.”

Until recently, utilities had limited visibility into the miles of power lines that serve their customers, relying on customer notifications to learn about power disruptions on their systems. Now, with emerging smart sensor technologies such as fault circuit indicators, they are able to bring a higher level of monitoring and control to power distribution assets, beyond the substation.

Smart grid sensors — small, lightweight nodes deployed in a variety of downstream devices — provide granular views of the distribution grid. Generally, utilities use them to monitor and report everything from faults to asset health, as well as for load management applications.

New Sensor Use Cases

Lower costs and increased functionality of sensors have removed many of the barriers to their adoption and utilities are finding more applications for them every day. Since sensors can provide real-time information about problems on the electric distribution system, outage management can be an important use case. “Line sensors on the section of the line that is out can help minimize the impact of the outage by enabling utilities for faster crew mobilization and by sending crews directly to the trouble spot,” says Tripathy.

Predictive asset management is another use case in which line sensors can transmit information to the head-end system whenever there are momentary outages caused by tree limbs or other objects coming into contact with a line. Data related to these momentary outages can be further analyzed in order to help the utility predict what may then become a sustained outage.

In addition to providing data for predictive analytics, sensors can help utilities track outages and analyze historic data to support decisions about asset management and future investments needed to minimize those areas that are prone to outages.

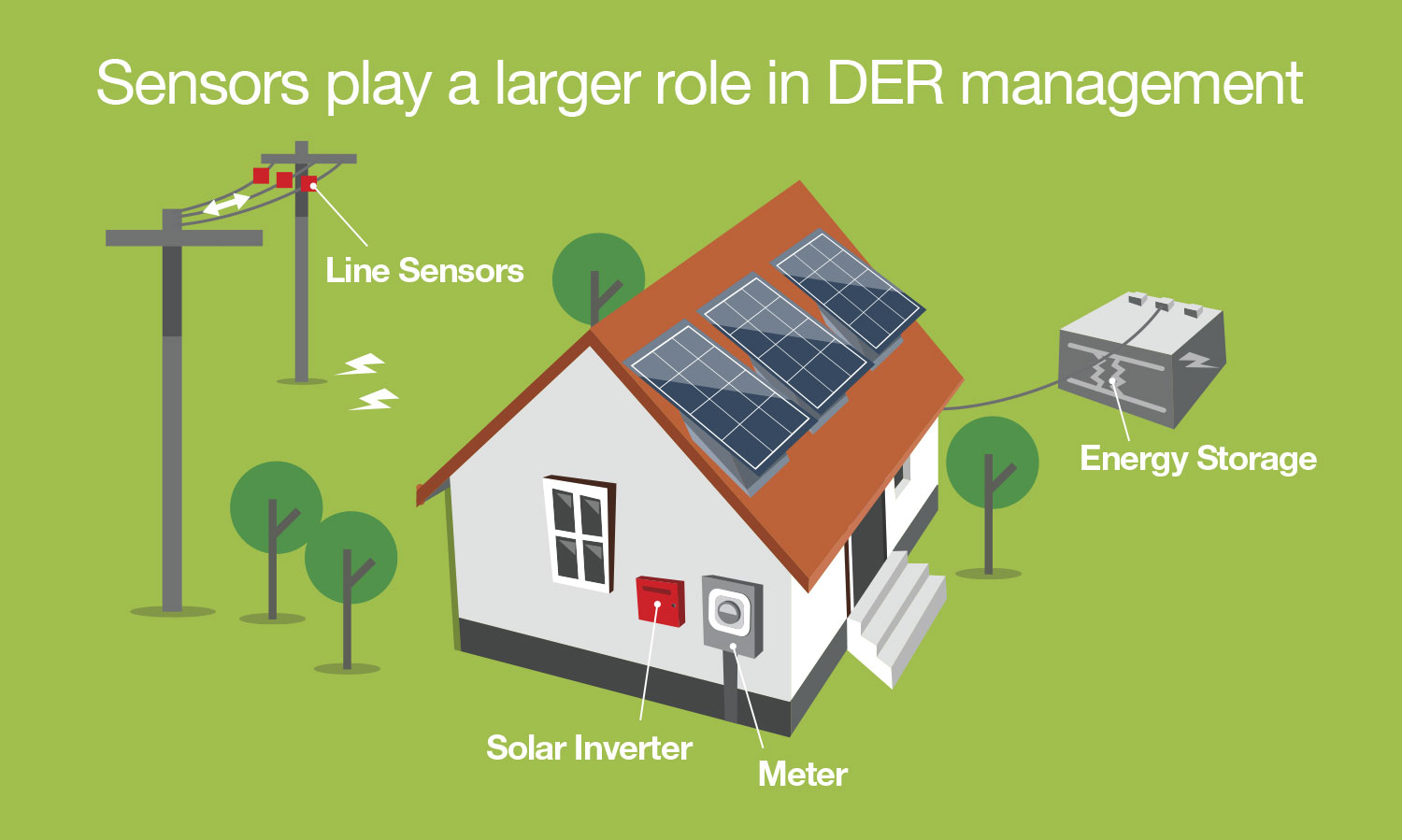

More and more utilities are also finding that sensors are valuable resources for their distributed energy resource (DER) management efforts. Line sensors work with smart meters and inverter controls to monitor the potentially negative impacts of residential generation on the network. In California, Hawaii and other states that are experiencing increasing penetration of DERs, sensors provide visibility into load direction changes and enable utilities to pinpoint locations for additional DER interconnection. Sensors can also help utilities study and manage harmonic changes that result from high solar feed-in activity.

Outside the distribution grid, emerging sensor technologies are also driving smart city applications, such as waste management (sensors indicate when containers are full for planning collection routes), smart traffic (sensors monitor traffic for smarter traffic signals), smart parking (sensors indicate parking spot availability), and more. [See Networks article in current eZine]

Utilities have started looking at ways smart city applications can be monetized. “That is an ongoing process right now,” says Tripathy. “Many are looking into the smart city concept and are launching pilot projects to see how their customers will respond.” San Diego Gas & Electric, for example, recently led an intelligent street light adaptive controls pilot project to demonstrate how a city can transform its largest electricity cost center into a profit center.

Utilities are quickly finding other new applications for sensors, including risk management. With smart sensor devices installed along the utility’s infrastructure, they are able to conduct real-time asset analysis of the position and condition of assts. “For the metering site, in addition to the induction meter, there are cases in which leak detection can be done using sensors,” says Tripathy. “So, that’s another application.”

Sensors in Practice

Today, utilities are reaping new benefits from advanced line sensors, such as helping utilities manage asset inventory and speed to deliver a more reliable and responsive distribution grid. Line sensor deployments at leading U.S. utilities have demonstrated significant improvements in system average interruption duration index (SAIDI), system average interruption frequency index (SAIFI) and customer average interruption duration index (CAIDI).

The evolution of sensor technology has also led to the development of a distribution transformer monitor. “The life of a distribution transformer is about 40 to 50 years,” says Tripathy. “If they’re actively monitored and managed, their lifespan can be elongated. At Landis+Gyr, we’re extending our knowledge of energy metering to develop a distribution transformer monitor that integrates sensors to collect and measure critical data directly from the transformer.”

Landis+Gyr is also leveraging the power of sensors to enable distributed intelligence for commercial gas line monitoring with the launch of an intelligent gas module used with correctors and pressure trackers to record and transmit pressure and temperature data.

With an aging infrastructure, an increasing number of extreme weather events, growing use of renewables and inefficient power balancing, the industry is looking forward to the development and application of sensor technologies for day-to-day management of the grid — as well as long-term planning applications. “The fact that sensor prices are going down is a major factor,” says Tripathy. “The other aspect that has enabled the increasing use of communicable sensors is the multi-purpose AMI network. Because the AMI network expands its benefits beyond just collecting meter data and opens the door to a wide range of applications to create a more intelligent distribution grid.”